- Property Tax Management

Annual Tax Appeals

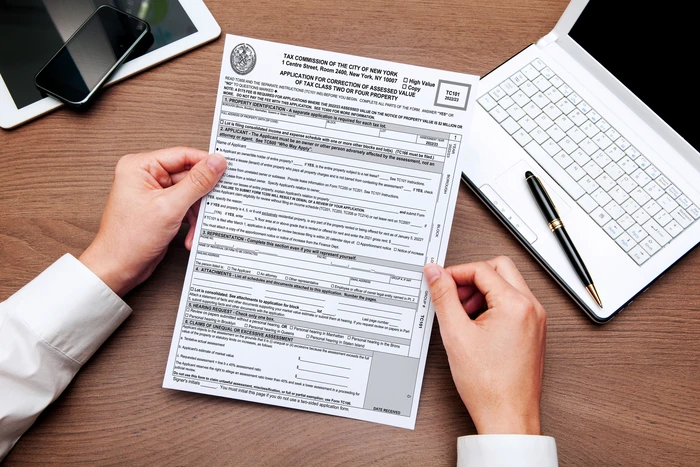

The NYC Tax Commission agency reviews taxpayers’ applications for correction of their assessed property value. This property tax appealtype has traditionally been the most effective because each case is personally evaluated by hearing officers, who are experienced appraisers and assessors. The deadline for application filing is March 1, and the requirements vary significantly among the different property types. There may be a number of attachments and schedules with the application.

The NYC Department of Finance (“Finance”) is required to annually reassess every parcel in New York City for the purposes of taxation. Finance itself provides some mechanisms to submit proof of the alleged errors on the taxpayer’s Notice of Property Value. The most widely used mechanism is the Request for Review (RFR). The deadline for filing is typically between mid-March and early April, depending on the property’s tax class.

One of the main benefits of this kind of property tax appeal is that it allows a City assessor to physically inspect the property in order to correct any valuation mistakes. It should be noted, however, that Finance may give these protests only a cursory review. It has been the Department’s position that it is NOT required to act upon any RFR.

MGNY has been successful in lowering property tax liability by requesting changes in the pertinent valuation data used by Finance, including, but not limited to, square footage, tax class, building class, income and expense estimates, and building occupancy/vacancy data.

If Finance deems it necessary to act upon the taxpayer’s request, the corrections – if any – are reflected on the Final Assessment Roll before the first tax bill is generated. This means that the taxpayer whose assessment is corrected via Change by Notice (before the final roll is published) need not wait for refunds or remissions. The savings are realized immediately.